Oil prices are rebounding with the fundamental outlook improving.

Energy pipeline etf.

If you want to browse etfs with more flexible selection criteria visit our screener.

As a result the vix etf is not intended as a stand alone long term investment.

Global x mlp energy infrastructure etf.

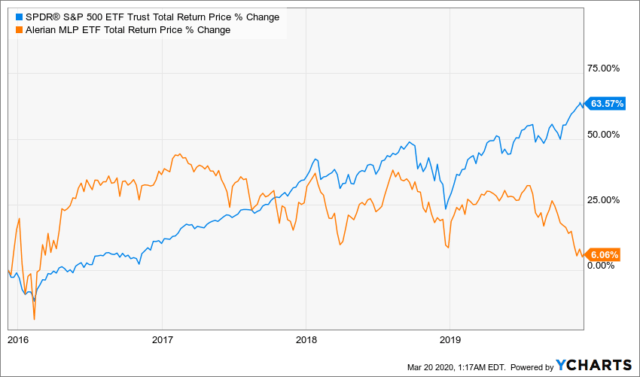

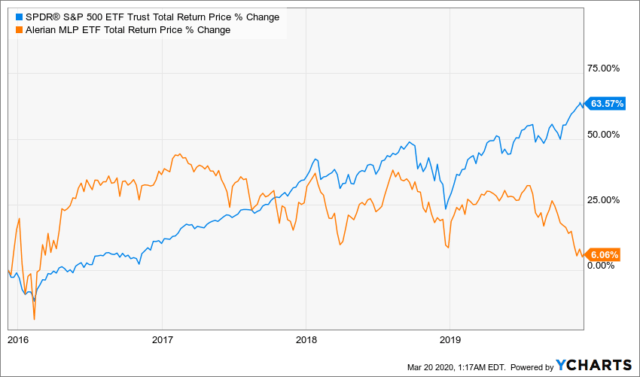

That s evident in the performance of the alerian energy infrastructure etf which is an exchange traded fund etf that holds both u s.

An etf for broad north america energy pipeline exposure.

Etf issuers are ranked based on their aggregate 3 month fund flows of their etfs with exposure to energy infrastructure.

Get answers to common etf questions.

By max chen on may 17 2016.

First trust north american energy infrastructure fund nysearca.

The energy spdr has more assets under management than any other energy sector etf and its portfolio of energy stocks spans the entire industry.

3 month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of different etf issuers with etfs that have exposure to energy infrastructure.

Global x mlp etf.

All values are in u s.

As more return to the energy play.

Emlp is an actively managed etf that holds canadian income trusts pipeline companies mlps and utilities that generate at least.

The vix etf which is a 1x etf as described in the prospectus is a speculative investment tool that is not a conventional investment.

To see more information of the mlps etfs click on one of the tabs above.

And canadian pipeline stocks as well as master limited.

Energy exchange traded funds invest primarily in stocks of natural gas oil and alternative energy companies the securities within an energy etf s portfolio may include major companies such as.

Historically the vix etf s target has tended to revert to a historical mean.

See how 9 model portfolios have performed in the past.

Mlps primarily operate in the energy pipeline.